Hindenburg Research

Hindenburg Research Predicts Something ‘Big’ Coming for India

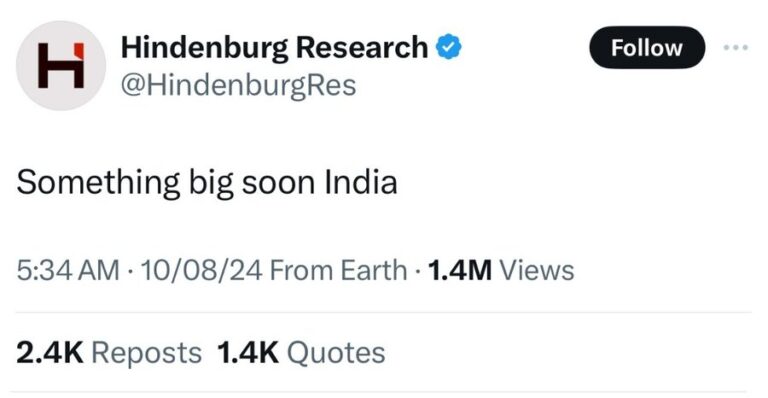

US-based short seller Hindenburg Research has sent shockwaves across the Indian business sector once more with a cryptic tweet implying a huge discovery involving an Indian company.

The tweet, “Something big soon India,” aroused widespread conjecture and alarm among investors and market experts. The firm’s earlier study on the Adani Group, released in January 2023, created a seismic shock, wiping billions of dollars from the conglomerate’s market worth.

What is Hindenburg Research?

Hindenburg Research is a U.S.-based investment research firm and short-selling company founded by Nathan Anderson in 2017. It specializes in forensic financial research and investigative journalism, with a primary focus on uncovering fraud, misrepresentation, and unethical business practices among publicly traded companies. Here’s a detailed overview of Hindenburg Research, its background, methodology, and the impact of its reports.

How does Hindenburg Research impact markets?

Hindenburg’s reports can have a significant impact on the markets by causing sharp declines in the stock prices of the companies targeted in its investigations. These reports often lead to increased regulatory scrutiny and legal actions against the companies.

How can investors protect themselves?

Investors can protect themselves by conducting thorough due diligence before investing in any company, diversifying their investment portfolio, and staying informed about market trends and regulatory developments.

A Look Back on the Adani Saga:

Hindenburg’s report on the Adani Group accused the conglomerate of stock manipulation and fraud, triggering a massive sell-off of its shares. The report detailed a complex web of offshore entities allegedly linked to the Adani family, raising serious questions about the group’s financial health and corporate governance

The Indian market regulator, SEBI, subsequently investigated the allegations. While the outcome of the probe is still awaited, the Adani Group has vehemently denied all charges.

Anticipation and Uncertainty

Hindenburg’s latest tweet has reignited fears of another potential market meltdown. Investors are on edge, with many wondering which Indian company could be the next target. The vague nature of the tweet has fueled a frenzy of speculation, with names of several high-profile Indian businesses being floated. The business community is bracing for impact, with concerns about potential market volatility and investor confidence. The government and regulatory authorities are likely to be on high alert, ready to respond to any situation that may arise.

As the clock ticks down to the anticipated revelation, all eyes are on Hindenburg Research. The coming days will be crucial in determining the extent of the impact on the Indian market and economy.

As the clock ticks down to the anticipated revelation, all eyes are on Hindenburg Research.